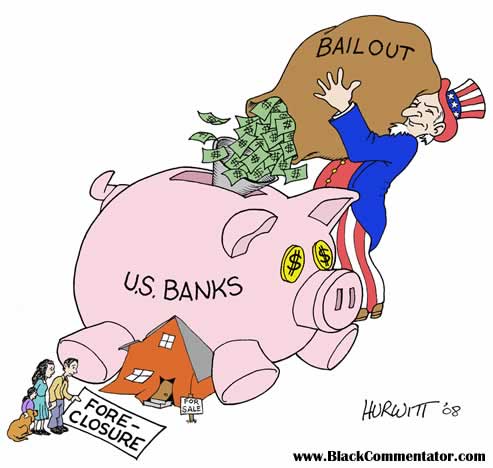

It has been some time now since the initial T.A.R.P. and markets have shredded all their previous gains. Unemployment is up to 7.6% and the markets are in desire need of more government help to stop this spiraling decent. As of February 5, 2009, Senate has approved

changes to the T.A.R.P. II, where another $900 billion will be injected into the banking system.

changes to the T.A.R.P. II, where another $900 billion will be injected into the banking system.There are many worries with the potential outcome of these banks. Some believe that the new T.A.R.P. II program will call for the nationalization of banks. Others believe that the government will provide a “Bad Bank” to store bad assets till the mature. Each has their shortfalls. If nationalization of the banks occurs, this will cause shareholders to lose their investments over the preferred shares of the government. Bank of America’s CEO, Ken Lewis, provided comfort stating that he's talked to members of Congress, regulators and government officials and that "it's not even a remote possibility and no one has mentioned nationalization." He has also said it the T.A.R.P. money will be repaid as humanly possible.

The end result is that the current economic situation is looking a lot more positive. With the government intervention of over $2 trillion dollars being planned on shorting our economy. It is almost impossible for things not to return to its natural state soon. Other things that provide stimulus are gas prices below $40 a barrel, average gallon of fuel of $2, and mega discounts for anything purchasable. It just up to us now to boost our confidence in the market and begin to spend again. Until then, we will be at the mercy of the government to provide an outcome.

Oscar A. Garcia

The new TARP or the "stimulus" package is actually a very political bill and is trying to establish democratic legislation for the years to come. The era of big government has arrived. Now Obama and others are using the same scare tactics as former secretary paulson to pass this bill. Government is the problem not the solution. Let the market recover without this massive spending plan. Promote more stimulus and less spending. Something like a 2 month tax holiday would immediately infuse capital into out economy. Its too bad this bill has become a political football.

ReplyDeleteInteresting subject.

ReplyDeleteThis shows how the politcal economy is derieved from it's ancestor's roots. This change and in a time of economic recession people must try to find a better homeland. The bailout has stirred much controversy in the white house, the republican horde, which has denied the bill seeks out to cut the resdue, uneeded spending. Hopefully this stimulus plan will bring a better outlook for America's core.

ReplyDeleteUpdate: The Big Plan

ReplyDeleteToday Treasury Secretary Timothy Geithner attempted to bring hopefulness to the market by reviewing the new T.A.R.P. II program publicly. Instead of hopefulness, Geithner brought uncertainty with a very vivid view of the new stimulus plan. Markets showed its disproval by selling off almost 5% or 400points in the DOW.

Your comments are understandable in that government intervention is not part of our economic theory of Adam Smith and his invisible hand. All economic problems will be moved by “the invisible hand” to put the markets back in equilibrium on the basis of supply and demand. But in this case, for us to allow the markets to find equilibrium by itself will cause this recession to last 10x longer. The Keynesian approach is more suited for such needed immediate action. Keynes attempted to explain that with high unemployment, their isn’t enough demand for the markets to correct themselves, and therefore in need of government intervention.

With the markets moving in favor of government intervention, this was a strong determinate of the need of this new stimulus plan. Once the economy is back on track. I am sure they’ll get out of our way for us to have normal growth once more.

O. Garcia